The Federal Reserve declared the most forceful loan fee expansion in almost 30 years, raising the benchmark acquiring rate by 0.75 rate focuses on Wednesday as it fights against flooding expansion.

The Fed’s strategy setting Federal Open Market Committee reaffirmed that it remains “emphatically dedicated to returning expansion to its 2% goal” and hopes to keep on raising the key rate.

As of not long ago, the national bank appeared to be set to endorse a 0.5-rate point increment, however financial specialists say the fast flood in expansion put the Fed slow on the uptake, meaning it expected to respond emphatically to demonstrate its purpose to battle expansion.

The super-sized move was the initial 75-premise point increment since November 1994.

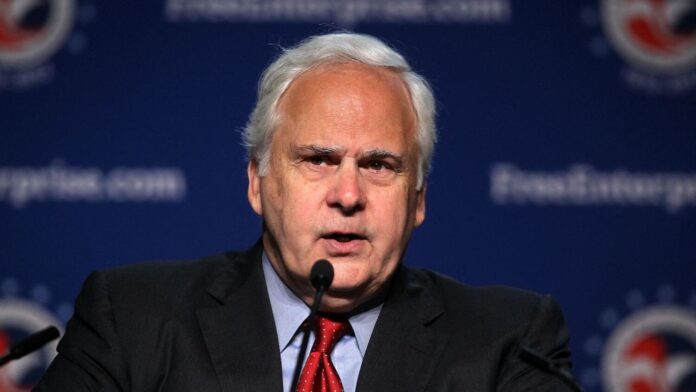

Taken care of Chair Jerome Powell will hold a public interview after the gathering to give more subtleties on the national bank’s arrangements, which will be firmly looked for signals on how forceful policymakers will be in coming gatherings.

Advisory group individuals currently see the government subsidizes rate finishing the year at 3.4 percent, up from the 1.9 percent projection in March, as per the middle quarterly figure.

They additionally expect the Fed’s favored expansion list to ascend to 5.2 percent before the year’s over, with GDP development easing back to 1.7 percent in 2022 from the past 2.8 percent figure.

The FOMC noticed that impacts of Russia’s assault on Ukraine are “making extra vertical tension on expansion and are burdening worldwide financial movement.”

What’s more, progressing Covid-19 lockdowns in China “are probably going to fuel production network disturbances.”

Kansas City Federal Reserve Bank President Esther George, a prominent expansion peddle, contradicted from the council vote, leaning toward a more modest, half-point increment.

US national brokers started raising financing costs off no in March as light interest from American customers for homes, vehicles and different merchandise conflicted with transportation and store network growls in regions of the planet where Covid-19 remained — and remains — a test.

That energized expansion, which deteriorated after Russia attacked Ukraine in late February and Western countries forced steep approvals on Moscow, sending food and fuel costs up at a rankling rate.

US gas costs have topped $5.00 a gallon out of the blue and are setting new records day to day.

Financial specialists thought March was the top for buyer cost climbs, however the rate spiked again in May, bouncing 8.6 percent in the most recent a year, and discount costs flooded too, primarily because of taking off costs for energy, particularly fuel.

The Fed was surprised with the speed of the cost increments, and keeping in mind that policymakers ordinarily really like to plainly broadcast any approach shift to monetary business sectors, the most recent information changed the math.

Powell had demonstrated policymakers were ready to carry out another half-point expansion in the benchmark getting rate this week and a comparable move one month from now, meaning to soak super hot expansion without tipping the economy into downturn and stay away from an episode of 1970s-style stagflation.